Despite fluctuating interest rates and limited inventory, the housing market in Maricopa County has demonstrated resilience, with home prices continuing to appreciate. Analysis of the median sales prices over the past decade reveals a significant upward trend. For example, the median sales price in June 2024 reached $479,000, a substantial increase from $222,500 in June 2015. This appreciation has occurred even as the market faced high interest rates, underscoring the strong demand and limited supply in the area.

Recent predictions from Citi analysts suggest a potential 200bps drop in the federal rate by July 2025, with the first decrease expected in September 2024. However, it’s important to understand that even such a reduction won’t bring mortgage rates back to the historically low levels seen during the pandemic. For instance, a 200bps drop may reduce mortgage rates from 6% to around 4%, but this still falls short of the 2-3% rates many homeowners currently enjoy. Consequently, these homeowners are unlikely to sell, maintaining limited inventory and sustaining high home prices.

To illustrate the affordability challenge, consider a family of four with a median annual income of $93,500. At 30% of their income, their affordable housing cost is around $2,338 per month. Given the current median home price and assuming a 20% down payment with a 30-year fixed mortgage at 5%, the monthly payment would be approximately $2,500 to $3,000. Even with a rate drop to 4%, the payment would still be around $2,200 to $2,400. This slight reduction does not significantly enhance affordability, highlighting that the crux of the issue lies in the disparity between home price appreciation and income growth.

The limited inventory, driven by homeowners clinging to low mortgage rates, and the steady price appreciation create a challenging environment for new buyers. The appreciation of home prices has outpaced income growth, further widening the affordability gap. Without significant policy measures to increase housing supply or substantial wage growth, these challenges are likely to persist.

For real estate and lending professionals, understanding these dynamics is crucial. Policy advocacy to incentivize new construction or zoning changes could help increase housing supply. Additionally, supporting income growth initiatives and educating consumers about financial planning are essential steps to mitigate these challenges.

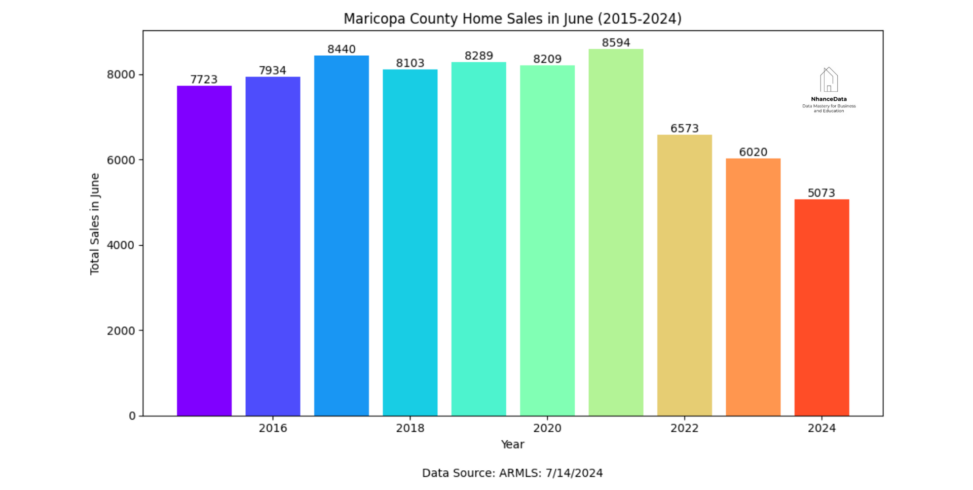

The visualization above highlights the sales trends in June over the past decade, illustrating both the sales volume and the median sales prices. This “June Swoon” comparison provides a clear picture of how the market has evolved, emphasizing the continuous appreciation despite varying economic conditions.

By analyzing these trends and understanding the broader economic impacts, professionals and consumers alike can navigate the Maricopa County housing market more effectively.

Leave a Reply