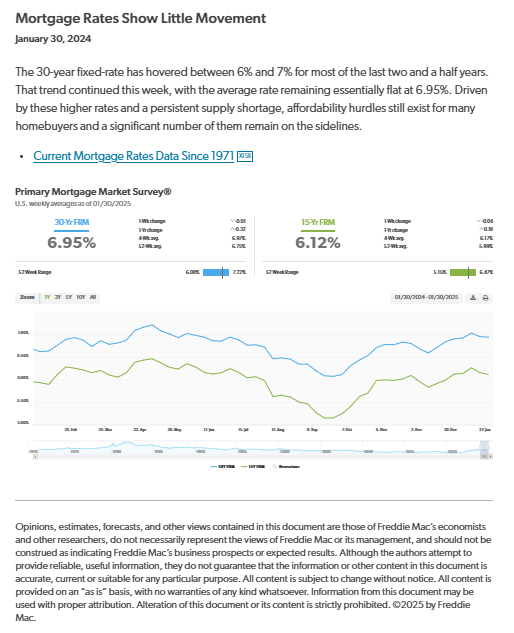

The latest data from Freddie Mac shows that mortgage rates continue to hover between 6% and 7%, with the 30-year fixed-rate holding steady at 6.95% and the 15-year fixed-rate at 6.12%. This marks a trend that has persisted for over two and a half years, reflecting a relatively stable but elevated rate environment.

While rates have shown little movement recently, the broader economic landscape could introduce new variables that impact both mortgage rates and overall housing affordability—particularly the potential for new tariffs on imports from Mexico, Canada, and China.

How Tariffs Could Impact Mortgage Rates and Home Affordability

Tariffs often lead to increased costs for goods and materials, and the housing market is no exception. Here’s how this could play out:

Higher Construction Costs: Tariffs on materials like lumber, steel, and appliances could drive up the cost of new home construction. Builders may pass these costs on to buyers, making new homes less affordable.

Supply Chain Disruptions: Tariffs can create bottlenecks in the supply chain, causing delays and additional expenses that affect housing inventory levels. Limited supply with steady demand often leads to higher prices.

Inflationary Pressure: As material costs rise, inflation could tick upward. This may push the Federal Reserve to maintain or even increase interest rates to control inflation, indirectly affecting mortgage rates.

Impact on Buyer Demand: Higher home prices and borrowing costs can dampen buyer enthusiasm, potentially slowing the market and creating downward pressure on home values.

Navigating High Rates with Smart Strategies

In an environment where rates are stable but high, and affordability is under pressure, buyers can still find opportunities. One of the most effective tools is the temporary buydown:

2-1 Buydown: Reduces your interest rate by 2% in the first year and 1% in the second year before returning to the original rate.

3-2-1 Buydown: Lowers your rate by 3% in the first year, 2% in the second, and 1% in the third year.

These strategies can ease the financial burden during the initial years of homeownership, giving buyers time to refinance if rates drop in the future.

Let’s Talk About Your Options

With mortgage rates stable but economic uncertainties on the horizon, having the right guidance is crucial. Whether you’re buying, selling, or exploring your financing options, I’m here to help.

🏡 Need a Mortgage?

https://lnkd.in/gW78baJG

📅 Schedule a Consultation

https://lnkd.in/gKKypNek

🌍 Learn More About Buying and Selling

https://lnkd.in/gB3AayH4

📧 Email Me: rforeman@azmortgagegroup.com

Leave a Reply