| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

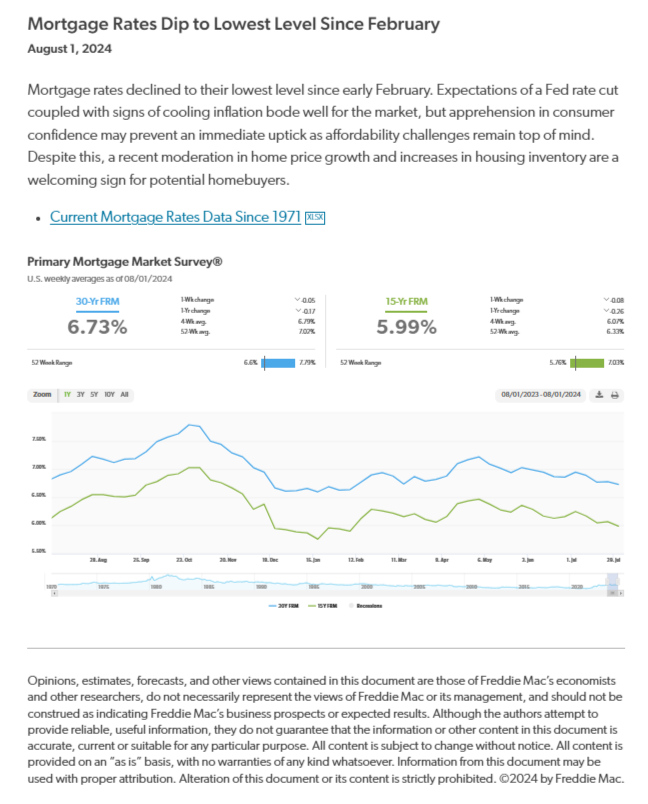

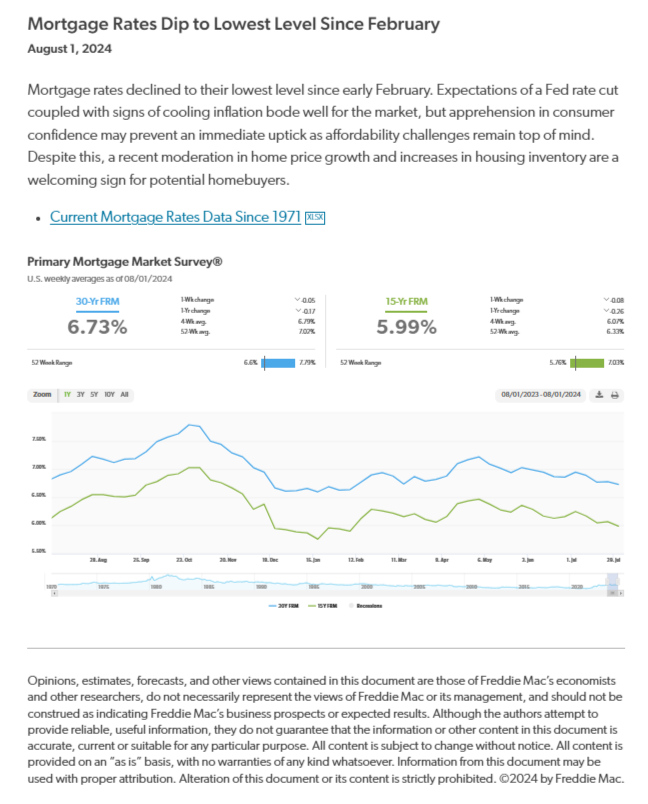

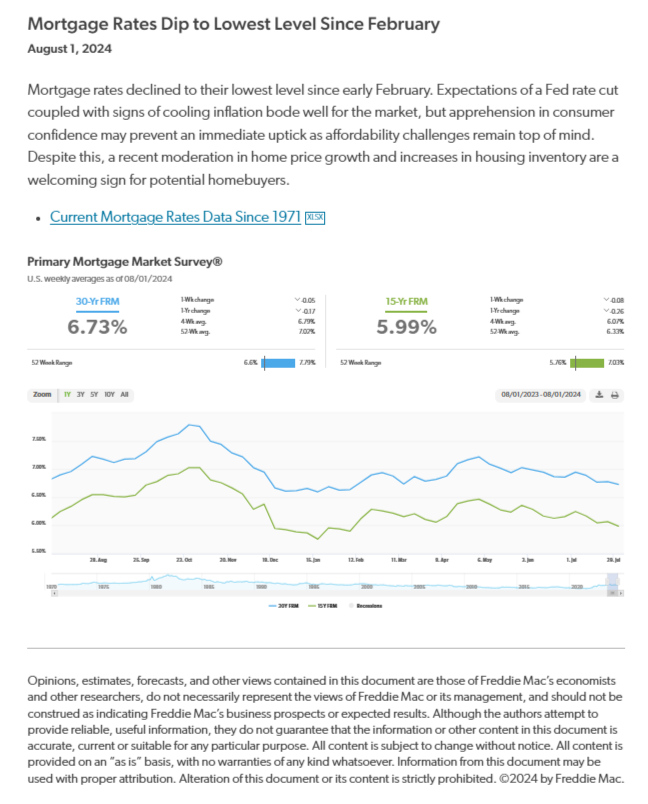

Mortgage Rates Decrease to Lowest Level in Over a Year

(Freddie Mac, August 8, 2024)

Mortgage rates plunged this week to their lowest level in over a year following the likely overreaction to a less than favorable employment report and financial market turbulence for an economy that remains on solid footing. The decline in mortgage rates does increase prospective homebuyers’ purchasing power and should begin to pique their interest in making a move. Additionally, this drop in rates is already providing some existing homeowners the opportunity to refinance, with the refinance share of market mortgage applications reaching nearly 42 percent, the highest since March 2022.

Considering Refinancing? Fed Rate Cuts Could Be Your Opportunity!

If you purchased your home from late 2022 until now, upcoming Fed rate reductions might make refinancing more attractive. A predicted 25 basis point cut could happen as soon as the end of the month. Lower your mortgage rate, reduce your term, or tap into your home equity for improvements and investments.

Options with Your Home Equity:

Pay off Student Loans

Consolidate Debt

Home Improvements

Eliminate Mortgage Insurance

Free Up Money to Invest

Buy Another Home

Call or message me today to discuss options.

I am your One-Stop for Real Estate and Mortgages.

Schedule an Online Consultation:

https://lnkd.in/dSyx2JC

What’s Your Home Worth?

Download an Instant Estimate at

ArizonaHouseValues.net

Search Phoenix Listings at

https://lnkd.in/gkmWvvm

Search New Build Communities at

https://lnkd.in/eRz8h9H

Source: Freddie Mac: https://lnkd.in/eZpg3k86