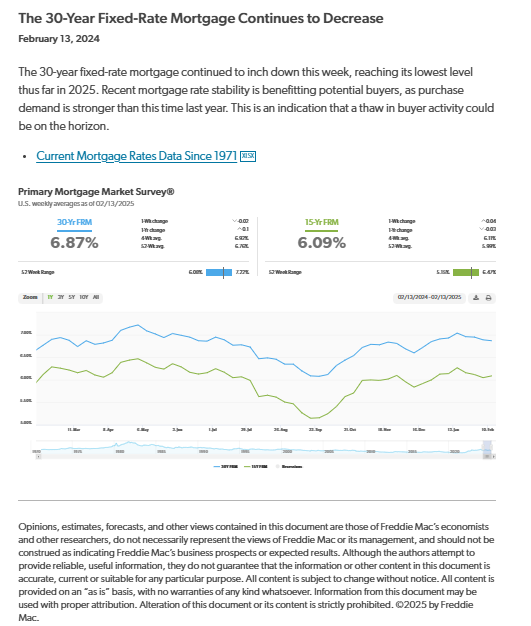

Mortgage rates continue their downward trend, with the 30-year fixed rate now at 6.87% and the 15-year fixed at 6.09%. This marks the lowest rate so far in 2025, signaling potential relief for buyers who have been waiting for the right time to enter the market. As rates stabilize, we’re seeing stronger purchase demand compared to this time last year, hinting at a potential thaw in buyer activity.

Take Advantage of Lower Rates with a Temporary Buydown

Even with rates decreasing, affordability remains a challenge. One of the best ways to lower your initial mortgage payments is through a temporary buydown:

- 2-1 Buydown: Your rate is 2% lower in the first year, 1% lower in the second, before adjusting to the original rate in year three.

- 3-2-1 Buydown: Drops the rate by 3% in year one, 2% in year two, and 1% in year three before returning to the full rate.

Why This Matters Now

✅ Lower Monthly Payments: Make homeownership more manageable in the early years.

✅ More Seller Incentives: Many sellers are willing to fund a buydown to attract buyers.

✅ Time to Refinance: If rates continue to fall, you can refinance before the full rate kicks in.

So, what should you do? 🤔

📞 Call me for an honest opinion on what makes the most sense for you. Whether it’s the right time to buy, sell, or wait, I’ll give you straightforward advice based on your situation—not my commission.

👉 Schedule an Online Consultation:

https://calendly.com/azhomesloan/30min

🏠 Curious About Your Home’s Value?

Download an Instant Estimate at ArizonaHouseValues.net

🔎 Search Phoenix Listings:

https://link.flexmls.com/155wxuiu649z,12

💸 Need a Loan?

👉 https://livinginphoenix.my.canva.site/arizona-loan-officer

The right move in real estate is the one that aligns with your goals—let’s figure it out together.

#MortgageRates #RealEstateMarket #BuyersMarket #SellersMarket #HonestAdvice #ArizonaRealEstate

Leave a Reply