What’s going on with the Adult Active market in Phoenix?

(Yes, this post has pretty graphs and charts).

The Adult Active market, catering specifically to age-restricted communities and properties, has its unique dynamics, trends, and buyer behaviors. But as external economic factors, like rising interest rates and inflation, begin to reshape the broader housing landscape, a pressing question emerges: Have these financial shifts impacted the Adult Active market in Phoenix in the same way they’ve influenced the general residential market? To shed light on this, I’ve delved into the latest sales data from ARMLS, concentrating on sales patterns from 2018 through to the current month.

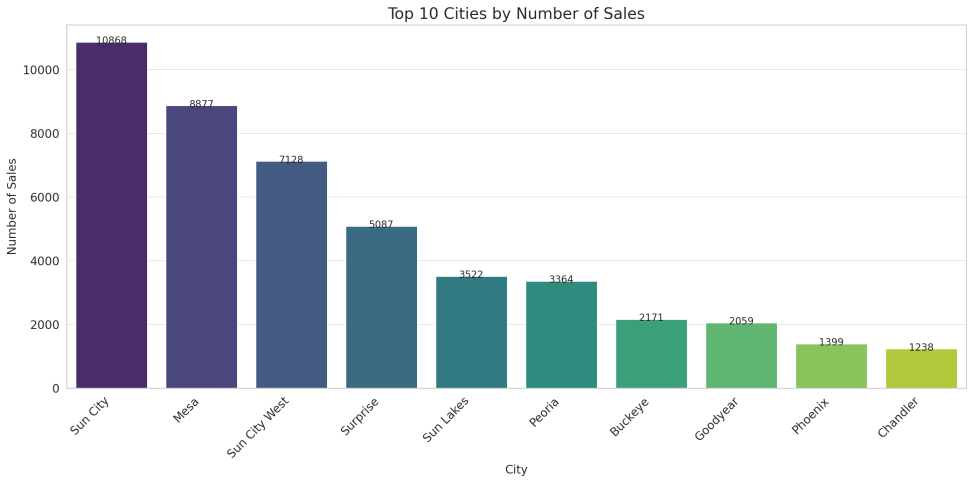

Number of Sales by City:

This metric provides insights into the popularity and demand for properties in different cities within the Phoenix metro area. Since 2018, Sun City has led the market with the highest number of sales, making it the most popular city for adult active sales. Sun City West and Surprise followed closely, highlighting their appeal to the adult active community. The data suggests that these cities offer favorable conditions or amenities that resonate with the target demographic.

Loan Distribution:

Loan distribution showcases the financing preferences of buyers in the market. The majority have opted for conventional loans, indicative of the traditional mortgage financing route being the most popular. A significant portion of the market also leaned towards cash transactions, indicating a segment of buyers making outright purchases without needing mortgage financing. This can be indicative of the financial readiness or preference of the adult active community in the region.

Median Sales Price:

The median sales price offers a central value of property prices in the market, giving insights into the affordability and valuation trends over time. Since 2018, there has been a notable upward trend in the median sales prices for properties in the top cities of the Phoenix metro area. The surge around early to mid-2020, followed by a stabilization and then a sharp rise from late 2021, can be indicative of various factors, including market demand, economic conditions, or external influences such as interest rates and inflation.

Days on Market (DOM):

DOM measures the average time properties stay listed on the market before being sold, serving as an indicator of market pace and demand. For most cities, the DOM has shown fluctuations over the years, with a general decrease in the latter part of the observed period. This suggests that properties in the adult active market in Phoenix have been selling faster in recent years, indicative of strong demand or efficient market dynamics.

Conclusion:

Starting from December 2021, when rates and inflation began rising, there was a clear impact on the median sales price in the adult active market, as observed in the sharp upward trend. This mirrors the behavior seen in the general residential market. The rising prices could be a result of increased costs getting passed on to consumers, reduced purchasing power due to inflation, or anticipatory buying before potential further rate hikes. The decreased DOM during this period suggests that despite the economic challenges, the demand in the adult active market remained robust, with properties selling faster than before.

Leave a Reply