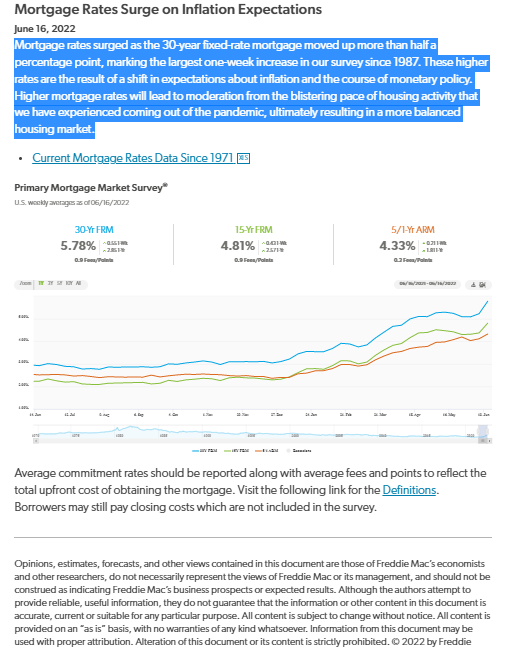

From Freddie Mac (6/16/2022):

“Mortgage rates surged as the 30-year fixed-rate mortgage moved up more than half a percentage point, marking the largest one-week increase in our survey since 1987. These higher rates are the result of a shift in expectations about inflation and the course of monetary policy. Higher mortgage rates will lead to moderation from the blistering pace of housing activity that we have experienced coming out of the pandemic, ultimately resulting in a more balanced housing market.”

Download the full report here:

ARIZONA HOMEOWNERS:

APPRAISAL CREDIT UP TO $600

CASH-OUT – DEBT CONSOLIDATION – HOME IMPROVEMENT – PURCHASE

CALL OR MESSAGE ME FOR TERMS AND CONDITIONS

Why wait for worsening rates or economic conditions?

Take advantage of historically low rates while you can.

How do you combat inflation?

DEBT CONSOLIDATION – CALL ME TODAY TO GET STARTED.

What can you do with your Home Equity?

Pay off Student Loans

Consolidate Debt

Home Improvements

Lower Your Rate And/Or Term

Eliminate Mortgage Insurance

Free Up Money To Invest

Buy Another Home

Your loan may qualify for an Appraisal Waiver

Call or message me today to discuss options.

I am your One-Stop for Real Estate and Mortgage.

What’s Your Home Worth?

Download an Instant Estimate at

ArizonaHouseValues.net

Need a Mortgage?

Apply Online at

https://lnkd.in/gGc7a2H

What are your options?

Let’s Discuss – Schedule a Free Consultation:

https://lnkd.in/dSyx2JC

Search Phoenix Listings at

https://lnkd.in/gkmWvvm

Source: Freddie Mac, 6/16/22

https://lnkd.in/dxiy78dU

#arizona #arizonarealestate #arizonarealtor #arizonaliving #phoenix #phoenixrealestate #phoenixaz #phoenixarizona #phoenixrealtor #phoenixrealestateagent #phoenixhomes #phoenixforyou #mortgagetips #mortgagerates #mortgagelender #mortgagerates #mortgages #realestatemarket #realestatebroker #realestate #realestateblog #brokersarebetter #valoans #conventionalloans #fhaloan #jumboloans #mortgage #luxury

Leave a Reply