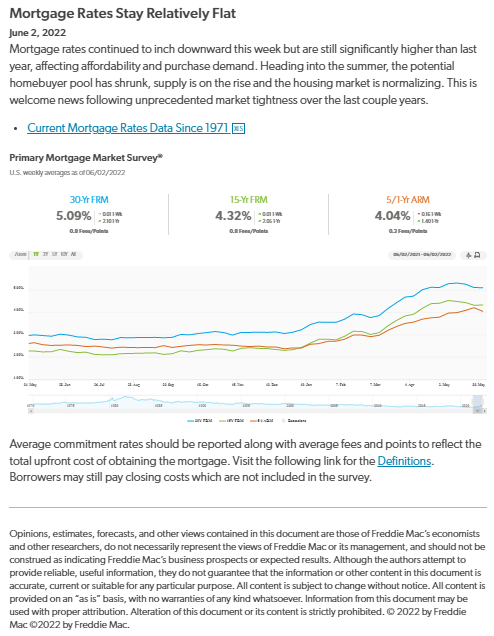

From Freddie Mac (6/2/2022):

“Mortgage rates continued to inch downward this week but are still significantly higher than last year, affecting affordability and purchase demand. Heading into the summer, the potential homebuyer pool has shrunk, supply is on the rise and the housing market is normalizing. This is welcome news following unprecedented market tightness over the last couple years.”

Download the full report here:

ARIZONA HOMEOWNERS:

APPRAISAL CREDIT UP TO $600

CASH-OUT – DEBT CONSOLIDATION – HOME IMPROVEMENT – PURCHASE

CALL OR MESSAGE ME FOR TERMS AND CONDITIONS

Why wait for worsening rates or economic conditions?

Take advantage of historically low rates while you can.

How do you combat inflation?

DEBT CONSOLIDATION – CALL ME TODAY TO GET STARTED.

What can you do with your Home Equity?

Pay off Student Loans

Consolidate Debt

Home Improvements

Lower Your Rate And/Or Term

Eliminate Mortgage Insurance

Free Up Money To Invest

Buy Another Home

Your loan may qualify for an Appraisal Waiver

Call or message me today to discuss options.

I am your One-Stop for Real Estate and Mortgage.

What’s Your Home Worth?

Download an Instant Estimate at

ArizonaHouseValues.net

Need a Mortgage?

Apply Online at

https://lnkd.in/gGc7a2H

What are your options?

Let’s Discuss – Schedule a Free Consultation:

https://lnkd.in/dSyx2JC

Search Phoenix Listings at

https://lnkd.in/gkmWvvm

Source: Freddie Mac, 6/2/22

https://lnkd.in/dxiy78dU

#arizona #arizonarealestate #arizonarealtor #arizonaliving #phoenix #phoenixrealestate #phoenixaz #phoenixarizona #phoenixrealtor #phoenixrealestateagent #phoenixhomes #phoenixforyou #mortgagetips #mortgagerates #mortgagelender #mortgagerates #mortgages #realestatemarket #realestatebroker #realestate #realestateblog #brokersarebetter #valoans #conventionalloans #fhaloan #jumboloans #mortgage #luxury

Leave a Reply