| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

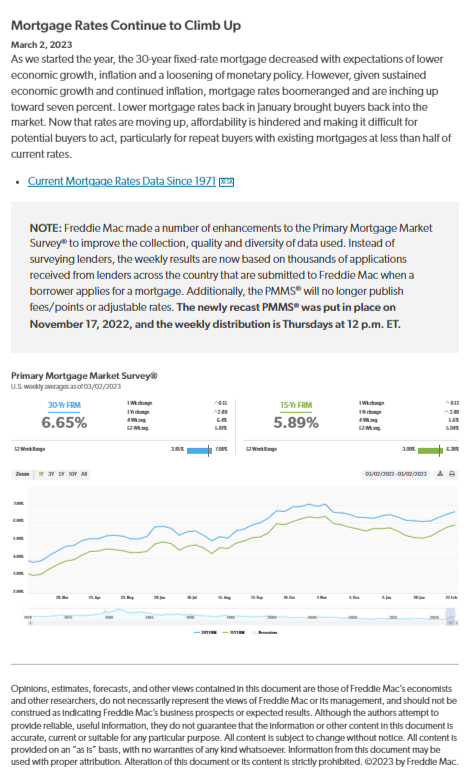

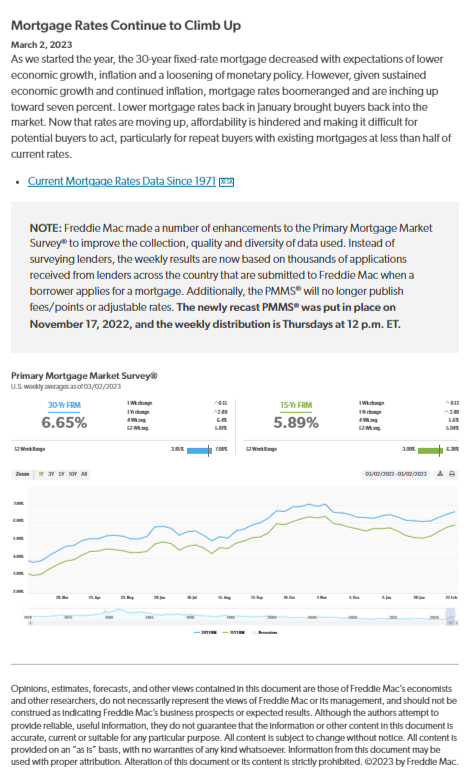

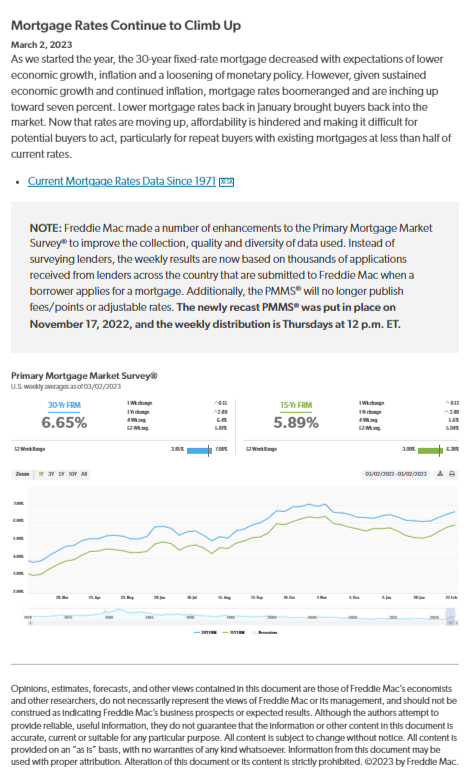

From Freddie Mac (3/2/2023):

“As we started the year, the 30-year fixed-rate mortgage decreased with expectations of lower economic growth, inflation and a loosening of monetary policy. However, given sustained economic growth and continued inflation, mortgage rates boomeranged and are inching up toward seven percent. Lower mortgage rates back in January brought buyers back into the market. Now that rates are moving up, affordability is hindered and making it difficult for potential buyers to act, particularly for repeat buyers with existing mortgages at less than half of current rates.”

Take advantage of your home’s historic appreciation while you can.

How do you combat inflation?

Tap into your home equity.

What can you do with your Home Equity?

Pay off Student Loans

Consolidate Debt

Home Improvements

Lower Your Rate And/Or Term

Eliminate Mortgage Insurance

Free Up Money To Invest

Buy Another Home

Call or message me today to discuss options.

I am your One-Stop for Real Estate and Mortgages.

Schedule a Free Consultation:

https://lnkd.in/dSyx2JC

What’s Your Home Worth?

Download an Instant Estimate at

ArizonaHouseValues.net

Need a Mortgage?

Apply Online at

https://lnkd.in/g2busXE

Search Phoenix Listings at

https://lnkd.in/gkmWvvm

Search New Build Communities at

https://lnkd.in/eRz8h9H

Source: Freddie Mac: https://lnkd.in/eZpg3k86

#arizona #arizonarealestate #arizonarealtor #arizonaliving #phoenix #phoenixrealestate #phoenixaz #phoenixarizona #phoenixrealtor #phoenixrealestateagent #phoenixhomes #phoenixforyou #mortgagetips #mortgagerates #mortgagelender #mortgagerates #mortgages #realestatemarket #realestatebroker #realestate #realestateblog #brokersarebetter #valoans #conventionalloans #fhaloan #jumboloans #mortgage #luxury