| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

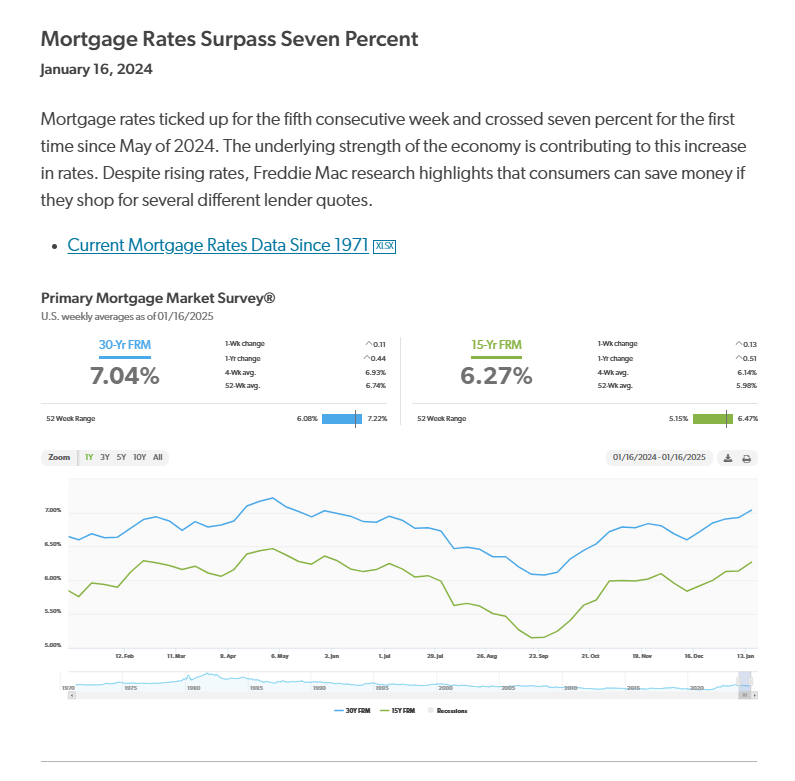

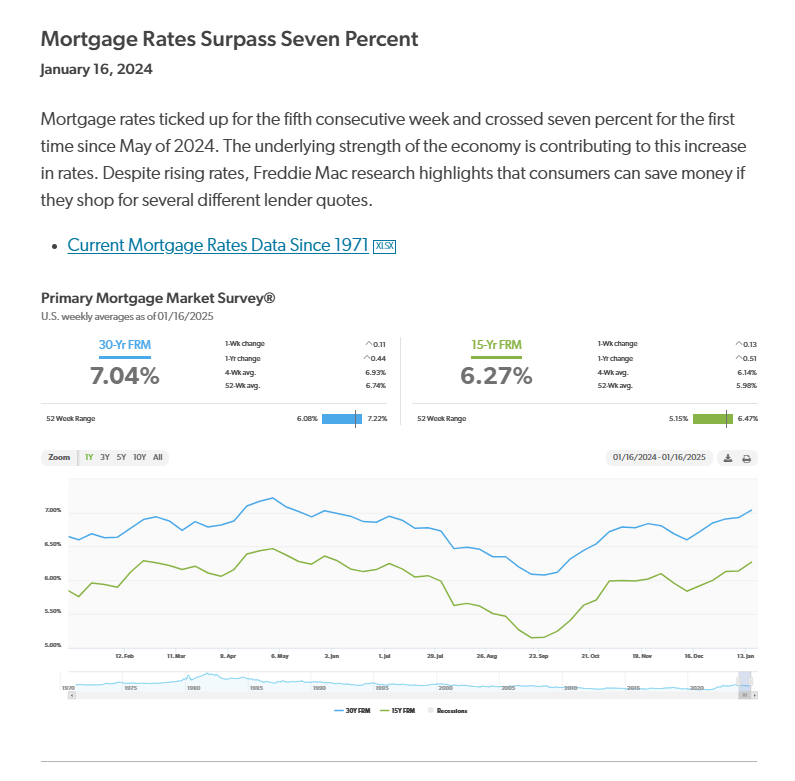

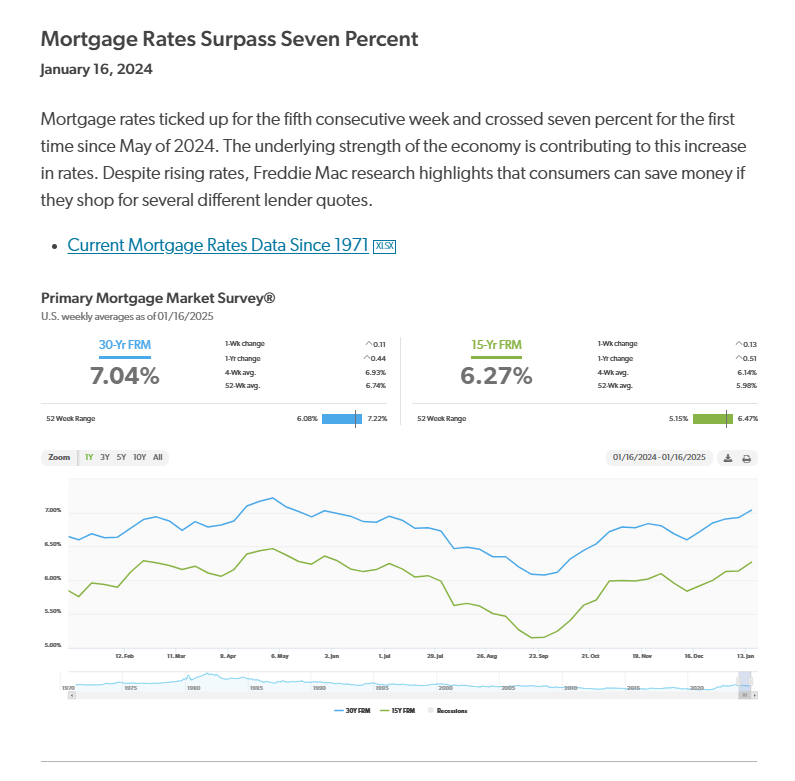

Mortgage Rates Surpass 7%—Why Temporary Buydowns Are More Important Than Ever

With mortgage rates climbing above 7% for the first time since May 2024, affordability is becoming a bigger challenge for many buyers. But here’s the good news: temporary buydowns are a powerful tool to help you navigate this high-rate environment.

What’s a Temporary Buydown?

A 2-1 or 3-2-1 temporary buydown allows you to lower your mortgage interest rate during the first 1-3 years of your loan.

2-1 Buydown: Your rate is 2% lower in year one, 1% lower in year two, and adjusts to the full rate in year three.

3-2-1 Buydown: The rate starts 3% lower in year one, then steps up 2%, and 1% before hitting the full rate in year four.

Why You Should Consider a Buydown Today

1️⃣ Lower Monthly Payments: Ease into your mortgage payments with significantly reduced costs in the first few years.

2️⃣ Seller-Paid Incentives: Many sellers are willing to fund buydowns to make their home more attractive to buyers.

3️⃣ Time to Refinance: If rates drop in the future, you’ll have time to refinance before the full rate kicks in.

4️⃣ Smart Budgeting: A temporary buydown provides financial breathing room while you settle into your new home.

Don’t Let High Rates Hold You Back

Freddie Mac research shows that shopping for the right lender can lead to significant savings. I’m here to guide you through your options and help you structure the perfect strategy for today’s market.

💰 Need a Mortgage? Start Here:

https://livinginphoenix.my.canva.site/arizona-loan-officer

📅 Schedule a Consultation:

https://calendly.com/azhomesloan/30min

Let’s make your dream of homeownership a reality—no matter the rates.

#MortgageBroker #TemporaryBuydown #PhoenixRealEstate #HomeBuying2024 #LoanOfficer #AffordableMortgages #MortgageStrategies #RealEstateTips #LivingInPhoenix