Another day of apocalyptic headlines as insiders, analysts, and media report about the coming residential real estate crash. The bubble is going to burst, foreclosures will rise, and interest rates will continue to increase. Most of these articles speak to national statistics – here’s an example from the Phoenix Business Journal:

https://www.bizjournals.com/phoenix/news/2022/07/18/foreclosure-starts-activity-pre-covid.html

You read the headline and you assume this applies to Phoenix. But when you wade through the article it highlights increased activity in other cities and states. Phoenix, Arizona for that matter, is not even mentioned. Why? Because it doesn’t apply to us today.

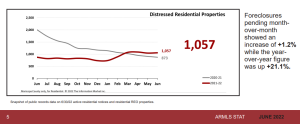

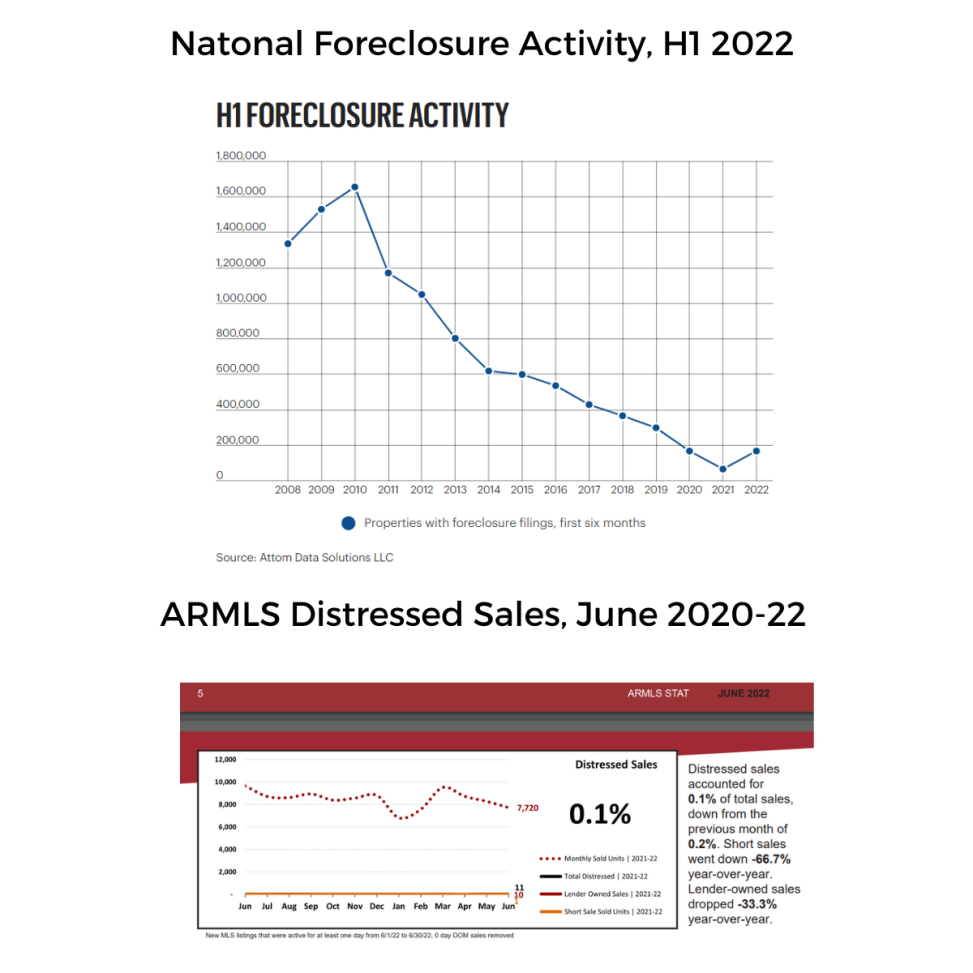

Check out the infographic:

There’s an uptick in foreclosure filings nationally but look how it compares to the Great Recession. It’s not even close to the levels we endured. Look at the Distressed Sales in Phoenix: not even 1% of the real estate transactions are lender-owned or short sales.

Is foreclosure activity increasing? No. Look at the graph below: it has flattened out after increasing from Q4 2021 through 1Q 2022. And the explanation for the bump in foreclosure activity is pretty simple: the foreclosure moratorium expired in June 2021. Pent-up cases were finally allowed to proceed through the legal process.

Because rates have increased, a lot of potential homebuyers who qualified for purchases last year are now knocked out of the market. But we have an inventory problem; it’s really bad. Arizona’s housing deficit has increased 1,377% since 2012 — representing 122,683 homes — according to a report by Washington, D.C.-based Up for Growth. That’s why people are still buying homes, even if it means increasing their housing budgets in the short term. For a lot of people, this may be the last chance to buy.

And the rewards are out there – not in price but incentives. Today, some builders and resellers are offering a wide range of closing cost incentives to attract buyers. For the past few years, I have rebated 25% of my commission to assist my clients with their closing costs. While there is a lull in the market, now is the time to become a homeowner. As history has shown, once we work through the recession (did I mention there’s a recession coming?), the Fed will begin lowering the federal funds rate, and we’ll see rates begin to lower.

To get an accurate appraisal of today’s real estate market, your agent and/or loan officer should be up to their ears in data daily; watching the 10-year treasury index and monitoring sales data within their MLS at the bare minimum. If they’re not doing the heavy-lifting, then you deserve better. Call or message me anytime to learn more about the market and what to expect in the coming months.

What’s Your Home Worth?

Download an Instant Estimate at

ArizonaHouseValues.net

Need a Mortgage?

Apply Online at

https://lnkd.in/gGc7a2H

What are your options?

Let’s Discuss – Schedule a Free Consultation:

https://lnkd.in/dSyx2JC

Search Phoenix Listings at

https://lnkd.in/gkmWvvm

#arizona #arizonarealestate #arizonarealtor #arizonaliving #phoenix #phoenixrealestate #phoenixaz #phoenixarizona #phoenixrealtor #phoenixrealestateagent #phoenixhomes #phoenixforyou #mortgagetips #mortgagerates #mortgagelender #mortgagerates #mortgages #realestatemarket #realestatebroker #realestate #realestateblog #brokersarebetter #valoans #conventionalloans #fhaloan #jumboloans #mortgage #luxury

Leave a Reply